Spend your money, time, & energy on purpose.

Living your life on purpose starts with knowing what REALLY makes you happy. Get started by downloading my FREE audiobook + workbook below!

Start learning now! Click an option below.

Brand new masterclass

5 Reasons Your Good Habits Don’t Stick

Downloadable free workbook

How To Stop Buying Sh*t You Don’t Need

Free ebook

How To Figure Out What Makes You Happy

Oh hey there,

I’m Sarah Von Bargen.

Want to look at your calendar and your bank statement and think “Yup, I made awesome choices”? I’ll show you how to spend your time, money, and energy on purpose.

How To Stay Motivated When You’re Not Seeing Progress (4 tips to try today!)

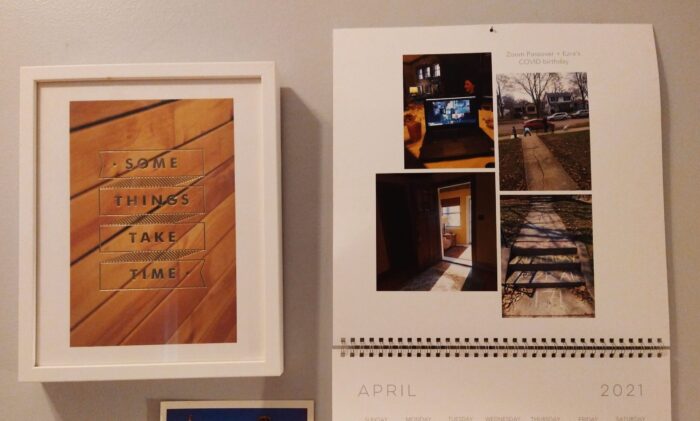

I got it for free, in an effort to use up an about-to-expire gift card.

It’s a framed print that says “Some things take time” and I chose it because the colors worked with my gallery wall.

But it hangs above my desk now because – as much as my Type A brain hates it – I truly need that reminder every day.

Can you relate? Struggling to stay motivated when you’re not seeing progress? That feeling of “I’m trying so hard but I’m not getting anywhere?”

If that’s you, welcome to the club! This is exactly what I teach in my Get What You Want Club goal-setting program (enrollment open now!) and here are 4 of my best tips to push through that “why am I not seeing results??” malaise.

4 ways to stay motivated when you’re not seeing progress

Track your proCESS, not your proGRESS

A very unfortunate truth is that progress is usually muuuuuuuuch slower than we’d like it to be.

Honestly, it’s pretty rude that my body hasn’t figured out how to run a six-minute mile when I’ve jogged for 20 minutes three times this week!!! And I should clearly have doubled my Instagram followers by now because I started putting hashtags in my Stories!!!

When we expect to see fast progress and we don’t, it’s very, very easy to give up.

So rather than tracking your progress – how many more pounds you can lift, how many interviews you got – track your process.

Examples of tracking your process:

- How many resumes you sent out

- How many emails you sent to cuties on that online dating platform

- How many hours you spent working on your novel

- How many times you did yoga this week

- How many calls you made to elected officials

- How many Instagram posts you published

I am not joking, using a paper chart that you fill with stickers every time you keep your promises to yourself is hilariously motivating.

Make that process as enjoyable as possible

Oh what’s that? It’s not enjoyable to work on your nursing school applications at 10 pm on Friday, from a cluttered dining room table, while your partner plays video games loudly in the background? WEIRD.

We’ll probably never confuse pursuing big goals with a day at the spa, but we can make pretty much any process significantly more enjoyable.

Goal: run marathon

Ways to make it more enjoyable: Find the loveliest training route possible, assemble an impeccable playlist, train with your funniest + most motivating friend, fill your closet with running gear that feels good and makes you feel cute.

You’re smart. You get the idea!

Reward efforts, not just outcomes

This is a hill I will die on! It is extremely difficult to stay motivated when we deny ourselves rewards and celebration till we achieve our goal.

Think about training your dog: It takes several weeks of consistent training to teach a dog to sit.

As your training your pup, you give her kibble or treats or pets every time you work together.

These rewards motivate her to enjoy the experience, to trust you, and to pay attention to you during future training sessions. You make the process enjoyable so she’ll want to keep doing it because you know it’s going to take a minute for her to achieve this goal.

But so many of us don’t extend the same grace to ourselves that we extend to …a dog. We do something a few times, deny ourselves any celebration or treats for making the effort, and then berate ourselves for not being great immediately.

So when you’re pursuing a big goal, plan ahead and think of how + when you’ll reward yourself for your efforts.

Sending 10 resumes = pedicure.

Meditating every morning for a month = dinner at your favorite restaurant

Listing your spare bedroom on Airbnb = hardcover edition of your favorite author’s new book

Did you see how we didn’t mention getting the interview, achieving enlightenment, or booking Airbnb guests? That’s because we’re celebrating ? efforts ? not ? outcomes.

Release the belief that you can control every aspect your progress

Three years ago, Kenny and I set a goal to buy a duplex so my mother-in-law could be our tenant, age in place, and we could all enjoy a low cost of living.

It took us two years to save up a 20% down payment, find a place that met our incredibly specific needs, and move across town.

Why? Because we couldn’t control:

- The Twin Cities’ housing market

- The Federal Reserve

- The personalities + preferences of sellers

- How many professional, full-time landlords we were bidding against

- Etc. etc. etc. x 1,000

And this is true for any goal any of us are pursuing! Knowing that we’re all going to encounter forks in the road and unexpected bumps will make us MUCH less likely to give up.

| Things you can control | Things you CAN’T control |

| How many houses you look at + which neighborhoods you’re looking in + how much you offer | How many homes are for sale + how much money other sellers are offering + which neighborhoods are getting trendy |

| Which dating apps you use + how many emails you send + how narrow or broad your dating criteria is | Who’s on the dating market + what they’re looking for in a partner + how they react to your dating profile |

| How you format your resume + the sort of cover letter you send + how many people you reach out to in your professional network + how many jobs you apply for | Who else is applying for the same job + the hiring manager’s personality/mood + the employer’s hiring budget |

And a final pep talk:

NONE OF THIS IS MAGIC. If you keep doing the things you said you were going to do – sending applications, going on dates, looking at houses, lifting weights – something is going to happen.

It’s very unlikely that you are the very rare human who could apply for 300 jobs and not get any job offers. Or look at 200 houses and not have your bid ever accepted.

Photo by Matéo Burles on Unsplash

Welcome to Yes & Yes!

Want to spend your time, money, and energy on purpose? I'll show you how.

Where To Start When You’re Not Sure Where To Start.

When she sends me the “I want to burn this place down” gif from Mad Men I know I need to actually call her - rather than send the usual series of heart and strong arm emojis. “What’s up?” I ask. I know things have been less-than-ideal in my friend’s life for a while now, but I didn’t realize we were talking season 7 Joan Holloway levels of frustration. “I hate it. All of it. This stupid job. My...

Stop Doing Things That Aren’t Working

Picture this: we’re sitting around a campfire in Yosemite on a crisp September night. We’re wearing cute flannel shirts, artfully scuffed jeans, and drinking out of those blue and white metal mugs that L.L. Bean sells. We’re taking turns swapping stories of wonder and woe. I shift on my camping stool, lean in, and terrify you with the tale of how my ego and self-absorption stymied my career for,...

The Trap Of The ‘Overly Virtuous Lunch’ + How To Avoid It

It is a truth universally acknowledged that bringing lunch to work is one of the best, smartest, most healthy choices a person can make. (snoooooore) Who among us hasn’t pledged to ‘do better’ and schlepped a Tupperware full of under-dressed lettuce across town, truly believing that come noon we’re going to eat that plastic box of leaves and enjoy it? When I was a classroom teacher, I’d do this...

How To Use Envy As A Tool (Yes, For Real)

I’m scrolling through Instagram as I wait for my coffee to brew when I’m hit by a wave of envy - mouth twisting, eye-narrowing, I-should-click-away envy. I stare at my screen, fantasizing about the day I can do what this woman does. I feel weak just imagining it. I give myself over to daydreaming about what life would be like if I could do this, too. What was it that filled me with envy,...

The ‘I Deserve It’ Loophole + The Trick I Use To Beat It

Picture this: It’s 8 pm on a rainy Friday night and you’re just now leaving work. The week has been a mess of unexpected expenses, grumpy coworkers, boring obligations, and yesterday the cat puked on your white sofa. Your mind is fried and your spirit is crumpled. Clearly, the answer is Target. Two throw pillows, three t-shirts, some face masks, and two art prints? You deserve them. When you get...

The Totally Unsexy Skill That Makes It Easier To Go After What You Want

When I was 32, I celebrated one of the biggest accomplishments of my life with a plate of nachos, a vodka gimlet, and gathering of friends at my favorite neighborhood bar. Over a plate of melted cheese, we cheers-ed my upcoming 11-month, nine-country trip. As the night wore on and more cocktails were consumed, one of my friends leaned across the table and said “Okay, I’m just gonna say what...